Are your Weekly Financial Management Meetings a blind spot? A blind spot is something we fail to see, it is out of your typical line of site and we miss what is there unless called to our attention. In this blog series we are going to talk about the 5 Blind Spots most business leaders with less than 50 employees have.

5 Common Blind Spots Leaders Have Are Not Seeing How To:

- Plan and Review Finance Planning & Execution

- Hold Employees Accountable in a Collaborative Way

- Run Superior Business Meetings

- Monitor Overall Company Performance

- Manage Financial Aspects of Your Company

The aim of this blog series is to remove these common business leader blind spots by focusing your attention on each issue and bringing visibility and understanding to concepts that will be easier to see and, therefore, improve over time.

Blind Spot #3 – Not Seeing the Value In Weekly Management Meetings

This article focuses on the third of five blinds spots many business owners have when trying to grow from 5 to 50 employees. In a previous article we discussed the first blind spot which was around not seeing the value around consistent company planning and the second blind spot focusing on how to maintain employee accountability.

The third blind spot lies in not realising the value and importance of weekly financial management meetings. Many jokes are made about finance meetings because good meetings are hard to come by, but when done well, an efficient, well-executed financial management meeting is an absolute game changer.

Do you struggle to see the value in weekly management meetings? If so, it is typically because you don’t feel you and your team have time to meet, when staying ‘productive’ seems to be a more practical use of your time. Another common issue is the feeling that financial management meetings aren’t very productive. Last but not least, a finance director can feel it is difficult, possibly even painful, trying to facilitate a meeting week over week when it seems to be a repetition of the previous weeks’ topics.

Truth be told, all those things can be legitimate challenges of past meetings, but it doesn’t have to be that way, and when weekly meetings are run well they will raise both the economic and productivity aspects of your business.

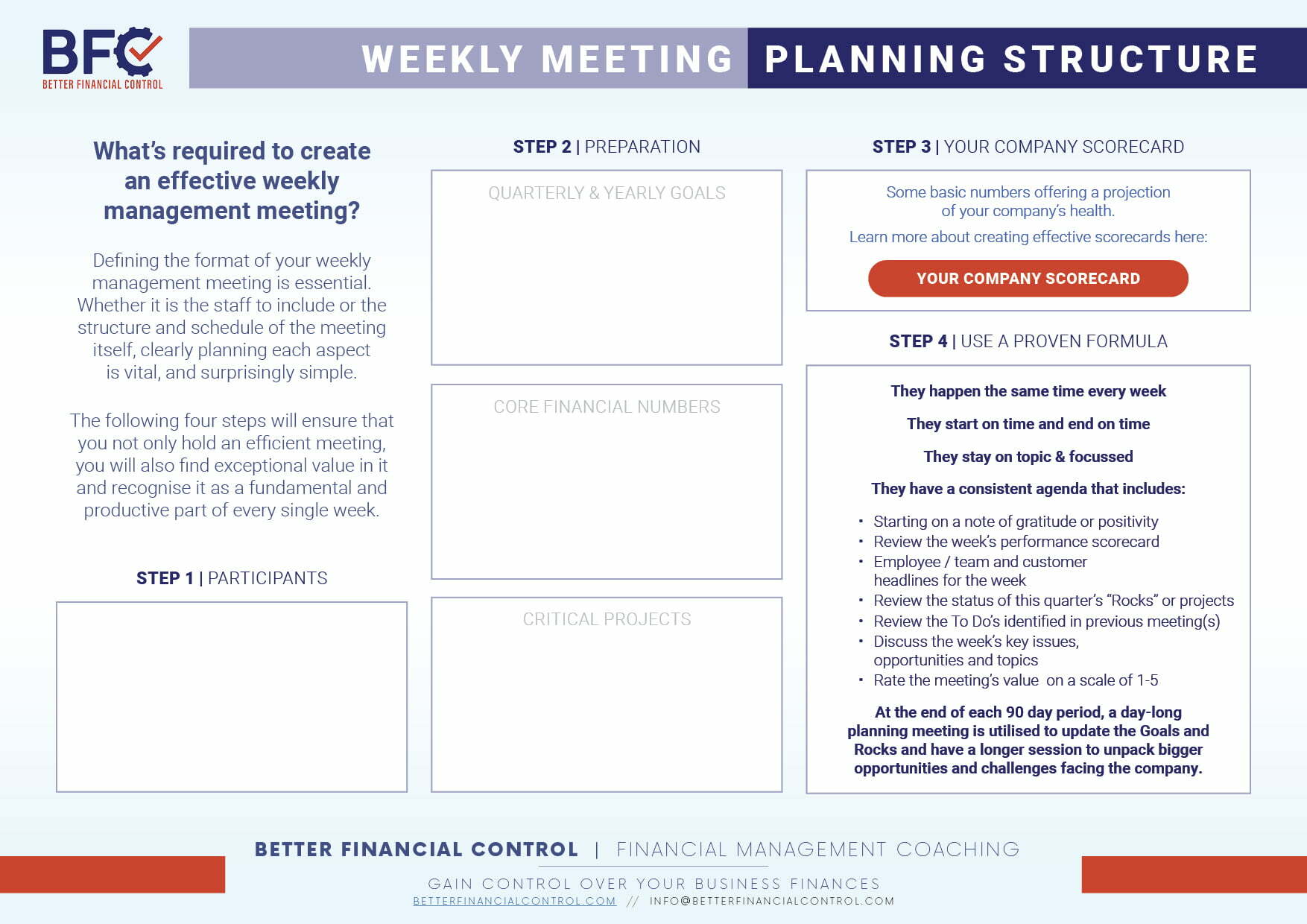

What’s required to create an effective financial management meeting?

Defining the format of your weekly management meetings is essential. Whether it is the staff to include or the structure and schedule of the meeting itself, clearly planning each aspect is vital, and surprisingly simple. The following four steps will ensure that you not only hold an efficient meeting, you will also find exceptional value in it and recognise it as a fundamental and productive part of every single week.

Step 1: Decide on who should be in the management meetings

If you have less than 10 employees it is likely everyone should be in the meeting. When the company grows, it can be reduced to the managers of the various departments. This is the team that needs to understand and fortify where you want the company to go. Without this clarity it is nearly impossible for them to make the best day-to-day decisions on how to achieve the results you want from them. Many accountability issues stem from a lack of understanding rather than a low level of commitment.

Step 2 – Prepare for your financial management meetings

You should have two key company documents and strategies in place:

1. Your quarterly and yearly goals. You will need to know where you want the company to go before you can begin having effective financial management meetings. These plans should include two key elements:

2. The core financial numbers that often include revenue, gross profit and sometimes a more net profit type of number like EBIT (Earnings Before Interest and Tax). Ideally, some KPIs (key performance indicators) can also be included but we don’t need to get too fancy out of the gate.

3. The critical projects the company needs to complete by the end of the quarter (or any 90 day cycle) to be able to hit the desired financial and strategic targets. Often in management books these ‘projects’ are referred to as “Rocks” and we do the same in our management consulting practice. Rock identification and completion is a topic unto itself but for the purpose of this article we will keep the concept to identification of how the company can most practically improve over the next 90 days to best move it towards its desired outcomes (vision, mission, BHAG, 1-3 year goals, etc.).

Step 3 – Have a practical company scorecard

Ultimately, you want to have a scorecard that monitors all relevant aspects of company performance but that often takes some time and effort to get right. Start with some basic numbers that offer an overarching projection of your company’s health. For example, your company revenue may seem like a valid number to track on your scorecard, but it is a ‘lagging indicator’. It doesn’t shed much light on how the company is performing this week because it requires invoice and/or money collection and demonstrates how the sales team was performing last month and your marketing the month before that. When you try to pick a few initial scorecard numbers to track it is often more effective to use more ‘leading indicators’ such as the number of proposals submitted or the number of new qualified opportunities for a projected period.

Regardless of which numbers you pick, begin measuring and documenting something consistently. There is a very good reason great business people consistently say, “what gets measured gets managed.” When you don’t measure with practical numbers you have no objective measuring stick for providing performance feedback.

Step 4 – Use a proven meeting formula

There is no reason to reinvent the wheel. Great weekly management meetings have the same attributes:

- They happen the same time every week.

- They start on time and end on time.

- They stay on topic and are not allowed to devolve into unfocused dialogue.

- They have a consistent agenda that includes:

- Starting on a note of gratitude or positivity.

- Review the week’s performance scorecard – regardless of how simple initially

- Share employee / team and customer headlines for the week

- Review the status of this quarter’s “Rocks” or projects.

- Review the To Do’s that were identified in the previous meeting(s) to ensure completion and accountability.

- Discuss the key issues, opportunities and topics that have come up over the previous week

- Rate the meeting on a scale of 1-5 on whether it provided value for the individuals attending and rating the meeting.

- At the end of each 90 day period, a day-long planning meeting is utilised to update the Goals and Rocks and have a longer session to unpack bigger opportunities and challenges facing the company.

In conclusion, weekly management meetings are often not seen as critical to a company’s success but this is due to a blindspot created by a history of negative meeting experiences.

By following the four steps outlined above, any existing blindspot will quickly and permanently be removed creating a new opportunity for greater employee accountability and buy-in along with significantly higher company performance.

Until next time, enjoy the process!

![Creating an Effective Business Operating System [Part 1] 2 Bfc Graphics](https://betterfinancialcontrol.com/wp-content/uploads/2023/05/BFC-Graphics-703x400.jpg)

![A Consistent Approach to Clarifying Your Business Strategy [Part 2] 3 Business Strategy](https://betterfinancialcontrol.com/wp-content/uploads/2023/03/BFC-Graphics-1-704x400.jpg)

![A Consistent Approach to Clarifying Your Company Strategy [Part 1] 4 Bfc Graphics](https://betterfinancialcontrol.com/wp-content/uploads/2023/03/BFC-Graphics-704x400.jpg)

![CrossFit for Your Business: A 3-Step Guide to Organise Your Business [part 3] 8 Organise Your Business](https://betterfinancialcontrol.com/wp-content/uploads/2022/11/5E5016F7-FE2E-42D8-AE63-37599B23E01B-704x400.jpeg)

![CrossFit for Your Business: A 3-Step Guide to Business Organisation [part 2] 9 Company Organisation](https://betterfinancialcontrol.com/wp-content/uploads/2022/11/BFC-Graphics-29-704x400.jpg)