Compared to the other critical Management Disciplines we have discussed, monitoring a practical Company Performance Scorecard is a less known, and less implemented concept.

This article focuses on the what, why, and how of creating and using a Company Performance Scorecard helps you to monitor, analyse, and control your finances for improved tax returns, better ongoing liquidity and stronger financial planning.

As a quick reminder, there are five core disciplines all business leaders need to ensure are well implemented and maintained to have a strong and adaptable business.

The five disciplines are:

- #1 The Discipline of Practical Company Planning

- #2 The Discipline of Using a Business Accountability Chart

- #3 The Discipline of Effective Management Meetings

- #4 The Discipline of Monitoring a Simple Company Scorecard

- #5 The Discipline of Better Financial Control

What is a Company Performance Scorecard?

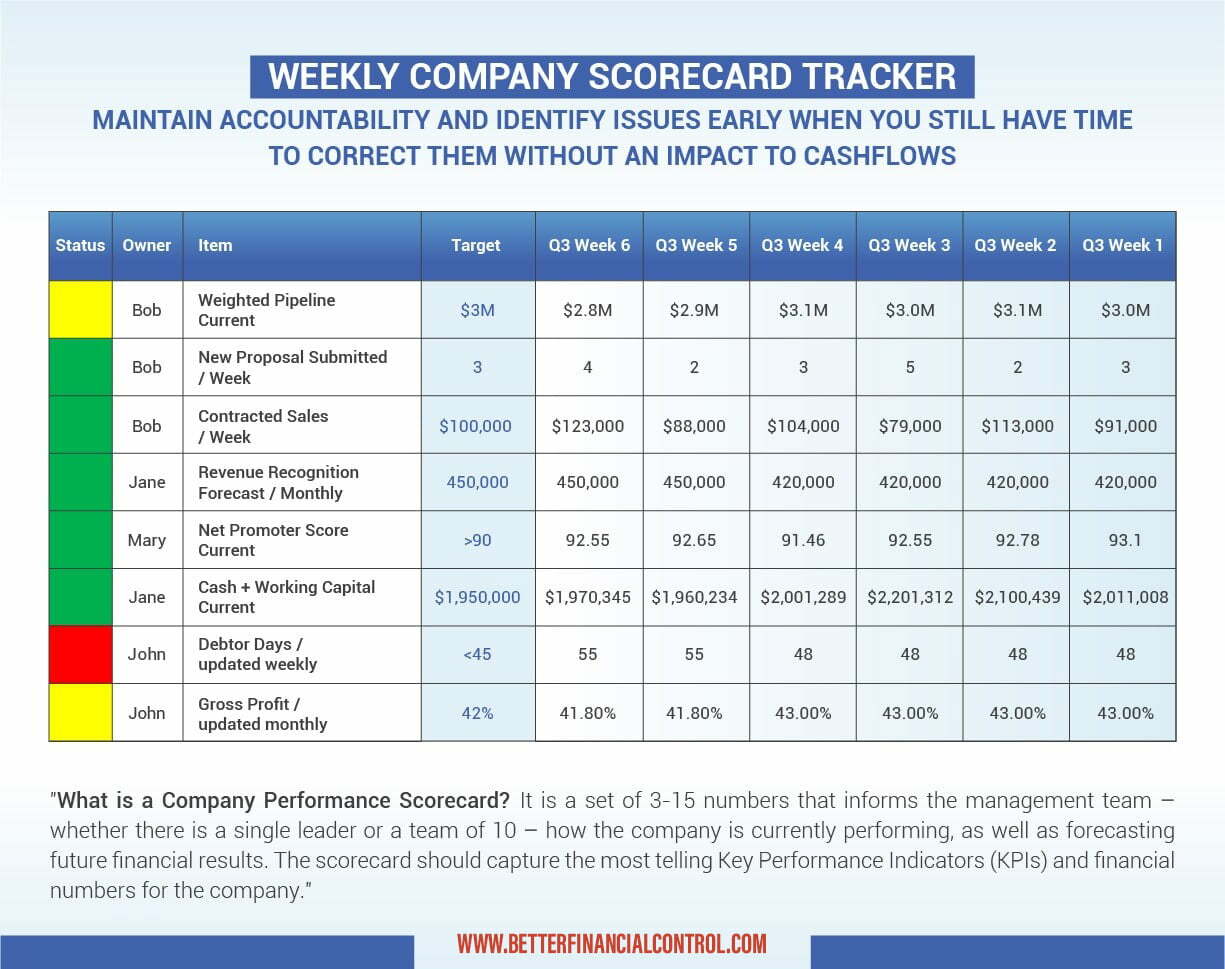

Your company’s performance scorecard is a set of figures that informs the management team – whether a single leader or a team of 10 – how the company’s finances are tracking over a given period, as well as forecasting future financial results. The scorecard should capture the most telling Key Performance Indicators (KPIs) and financial numbers for the company.

They say a picture is worth a thousand words, so we’ve created a Company Performance Scorecard Infographic for you to review below:

Why Should You Use a Company Performance Scorecard?

One key benefit of effectively using a scorecard is that it gives you more time to identify and fix your company’s financial fluctuations before they lead to significant issues or even irredeemable losses.

Recently, one of our business coaching clients identified a monthly revenue issue on their scorecard. Their sales were fantastic, but the issue was that COVID lockdowns were preventing them from invoicing for work that was being delayed, which created a problem in their overall financial control.

With this information, a company-wide initiative was created to reduce or defer costs until construction projects started back up again and revenue could be replenished.

This action helped mitigate a downstream problem of decreasing company profitability for the month and quarter. This quick action reduced their immediate costs and created greater long-term financial stability.

Monitoring your key performance indicators not only helps management teams identify and take action earlier, it also increases the entire company’s financial awareness and fluidity.

When you can provide a metaphorical ECG to your team, they begin to understand the working organism of your business, and that their actions can have incredibly positive repercussions. This gives them both a sense of responsibility and accountability, and greater purpose, motivation and even pride in their work.

How Can You Create an Effective Company Performance Scorecard?

It is important to understand that every company is its own unique set of KPIs. A good starting place for clarifying your own company’s financial health is to imagine you are cut off from receiving any information on your company except for five figures each week.

What would those five figures be?

In our financial coaching practice, we find that the quantity of these weekly numbers typically increases from five to 10 once you begin to consider the breadth of the company and the range of monetary details you require.

If a company wants more depth in the scorecard numbers, they may want to include Debtors’ Days in addition to a Current Accounts Receivable number. Your staff’s paid holiday and sick hours, various company overheads, expense claims and so on all become key pinpoints in your company’s financial profile.

If a Company Performance Scorecard is new to you and your company, start simple. Begin with the most telling financial metrics.

As you develop the discipline to report on these numbers accurately, you can add just enough additional numbers to give the scorecard more of a balanced feel. This scorecard maintenance process includes some art, some science, and slight adjustments from time to time.

Hopefully this information provides you with the details and justification to implement (or revisit) your company’s Performance Scorecard. As always, let us know if we can answer any questions as you gain to better financial control.