Effective financial management is essential to the longevity and stability of your business. However, if we only focus on the top line – the balance of our bank account – we leave ourselves open to a significant blind spot.

Without proper monitoring, you are casting a wide shadow upon your company’s potential, creating a larger blind spot that can undermine even the best business. In this blog series we are going to talk about the 5 Blind Spots most business leaders with less than 50 employees have.

5 Common Blind Spots Leaders Have Are Not Seeing How To:

- Plan and Review Finance Planning & Execution

- Hold Employees Accountable in a Collaborative Way

- Run Superior Business Meetings

- Monitor Overall Financial Performance

- Manage Financial Aspects of Your Company

The aim of this blog series is to remove these common business leader blind spots by focusing your attention on each issue and bringing visibility and understanding to concepts that will be easier to see and, therefore, improve over time.

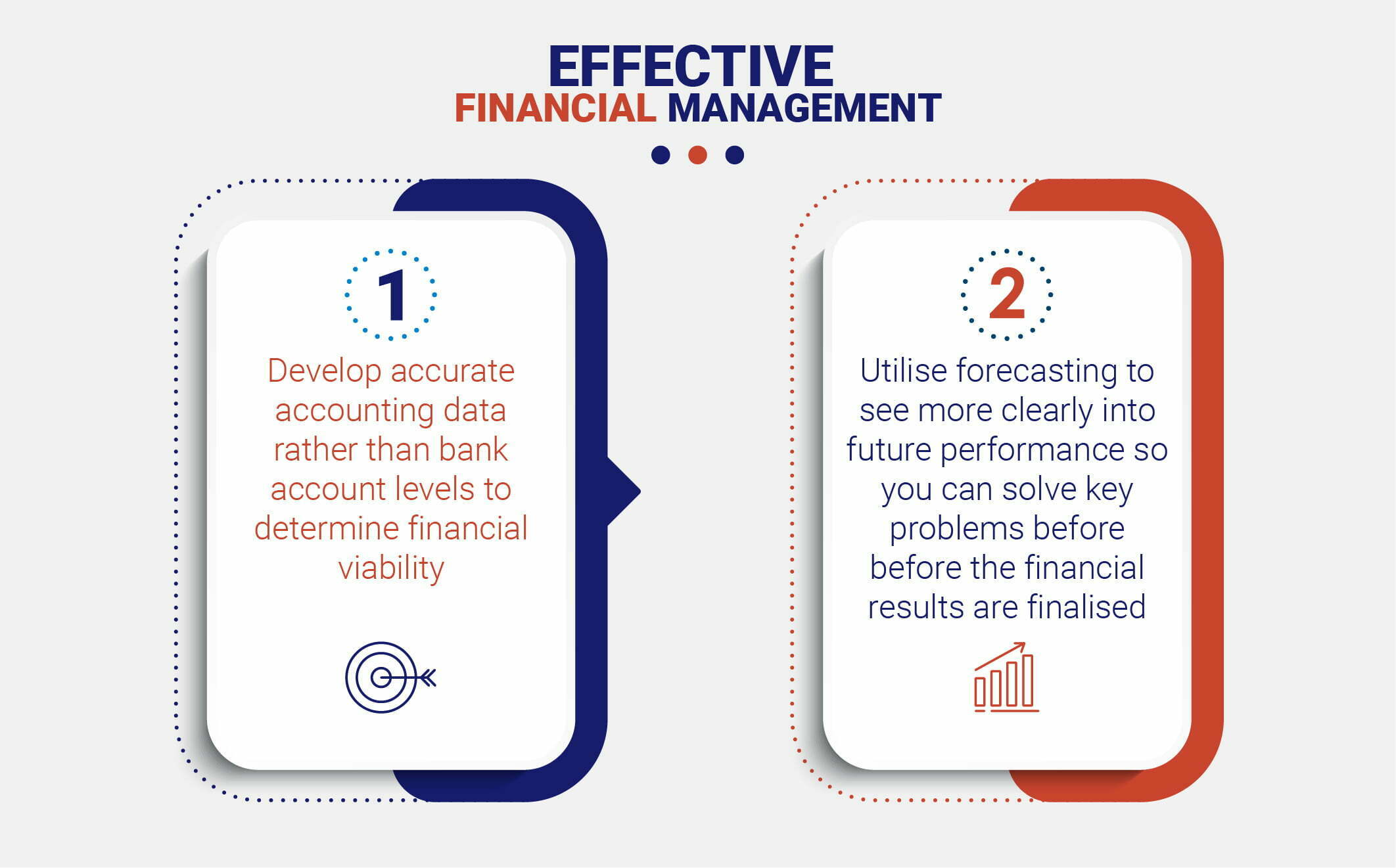

Blind Spot #5 – Failing to Implement Effective Financial Management

This article focuses on the fifth and final blind spot many business owners have when trying to grow from 5 to 50 employees. In our previous article we discussed the first blind spot: not seeing the value around consistent company planning. The second blind spot focused on how to maintain employee accountability, while the third highlighted seeing the importance of high-quality weekly management meetings.

Last week, we highlighted the importance of efficient company performance monitoring, which brings us to the final blog of our series.

The fifth blind spot involves not developing effective financial management within your company. Too often business owners begin their business on a shoestring and adapt to monitoring cashflow by how much money they have in their bank account.

Although this is never advised it can work initially when the financial numbers and expenses are small. This quickly changes, however, and when revenues and costs go up it becomes impossible to develop effective financial management based on your balance alone.

Effective Financial Management Pitfalls

The most classic miscalculations for more effective financial management come in the form of tax bills and annual costs that are not amortised over the whole time period. These ‘lumpy’ sporadic bills often drain the business accounts unexpectedly.

If too many of these surprises sneak up on you, the business rapidly develops in significant trouble.

Too often, the first strategy used by entrepreneurs is to forgo paying their taxes. The tax department then transitions to becoming a lending institution, with excessive rates of interest that only slip you further down the slope.

This dynamic often continues indefinitely.

When the company does well enough on the sales side of the ledger the company can work its way out of debt but too often the weight and stress of the tax bill becomes too much for the company and owner. This self-perpetuating dynamic continues, and eventually becomes too much for the company to endure.

Outsourcing Effective Financial Management

It doesn’t have to be that way. We find that eliciting the help of an outside entity like a virtual CFO team can dramatically improve both the dynamics and likelihood of business and effective financial management.

A team CFO-like advisors can act as an objective third party by removing the blind spots preventing effective financial management and quickly implementing objective checks to monitor how the company is financially performing.

This gives you greater accountability and streamlines the process of managing your outgoing financials.

A more specific blind spot of effective financial management that virtual CFOs can help with is with cashflow forecasting.

Even the most basic type of financial disciplines involve monitoring financial results in the form of monthly and quarterly financial reporting. Looking into the future is as important as looking in the rear view mirror at how a company has performed.

Effective forecasting offers insights into how the company will perform, providing all important feedback on what adjustments need to be made now to assure future financial success.

Effective Financial Management: Conclusion

Both strategies help a business owner and their team be more realistic in terms of how the company is performing.

In conclusion, it is important to recognise the tendency to guess how their company is performing based on isolated figures.

This avoidance of objective and predictive information exposes an owner and their business to a great deal of unnecessary risk. Virtual CFO teams are substantially cost-effective. Thus it is fitting to say, ‘an ounce of prevention is worth a pound of cure’!

Remove the financial management blind spot today and start better monitoring both what the company’s needs are now as well as how it will likely be performing over the next 30-60 days.

Until next time, enjoy the process!

Need more assistance with effective financial management? Contact us today for more financial insights.

![Creating an Effective Business Operating System [Part 1] 2 Bfc Graphics](https://betterfinancialcontrol.com/wp-content/uploads/2023/05/BFC-Graphics-703x400.jpg)

![A Consistent Approach to Clarifying Your Business Strategy [Part 2] 3 Business Strategy](https://betterfinancialcontrol.com/wp-content/uploads/2023/03/BFC-Graphics-1-704x400.jpg)

![A Consistent Approach to Clarifying Your Company Strategy [Part 1] 4 Bfc Graphics](https://betterfinancialcontrol.com/wp-content/uploads/2023/03/BFC-Graphics-704x400.jpg)

![CrossFit for Your Business: A 3-Step Guide to Organise Your Business [part 3] 8 Organise Your Business](https://betterfinancialcontrol.com/wp-content/uploads/2022/11/5E5016F7-FE2E-42D8-AE63-37599B23E01B-704x400.jpeg)

![CrossFit for Your Business: A 3-Step Guide to Business Organisation [part 2] 9 Company Organisation](https://betterfinancialcontrol.com/wp-content/uploads/2022/11/BFC-Graphics-29-704x400.jpg)